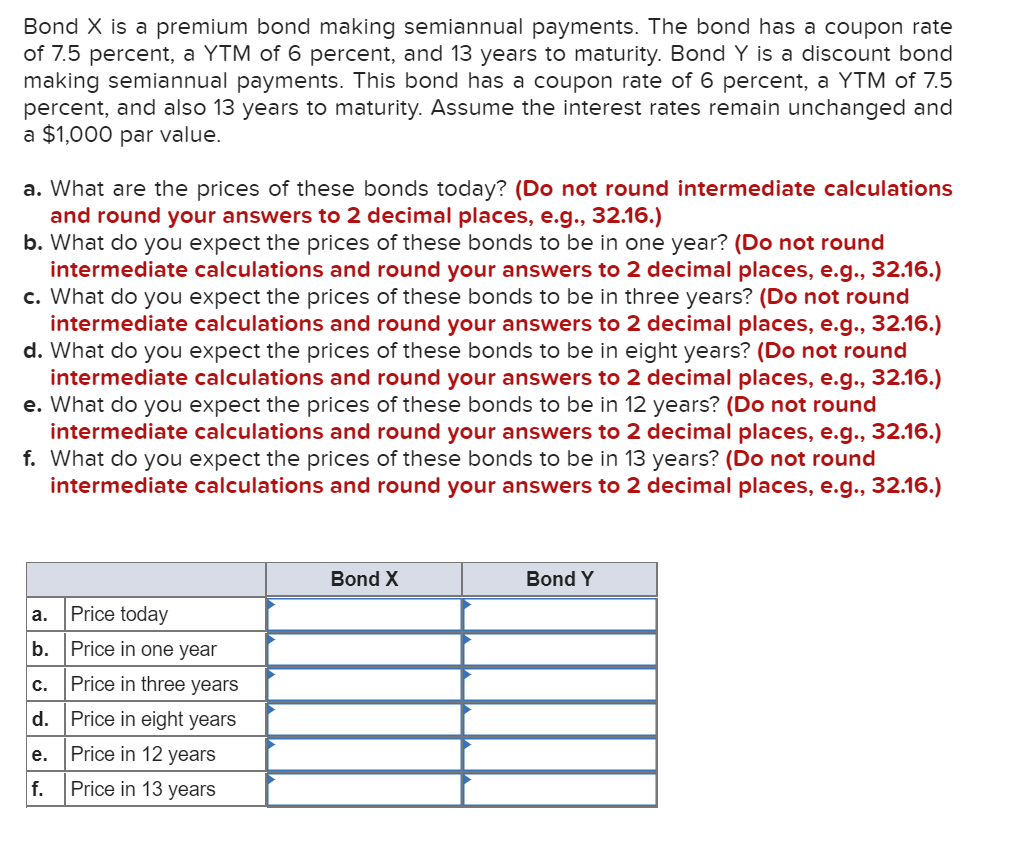

43 coupon rate vs ytm

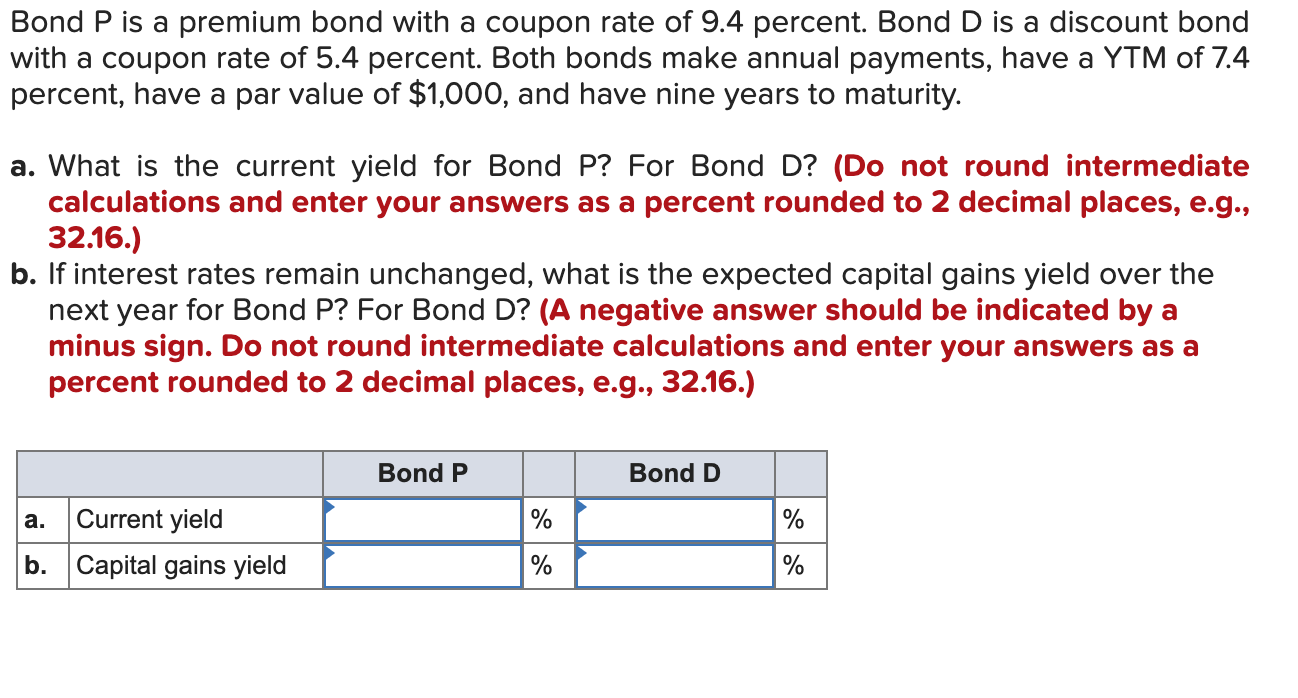

How are bond yields different from coupon rate? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the ... Difference between YTM and Coupon Rates YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity. YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is paid out on a ...

Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates.

Coupon rate vs ytm

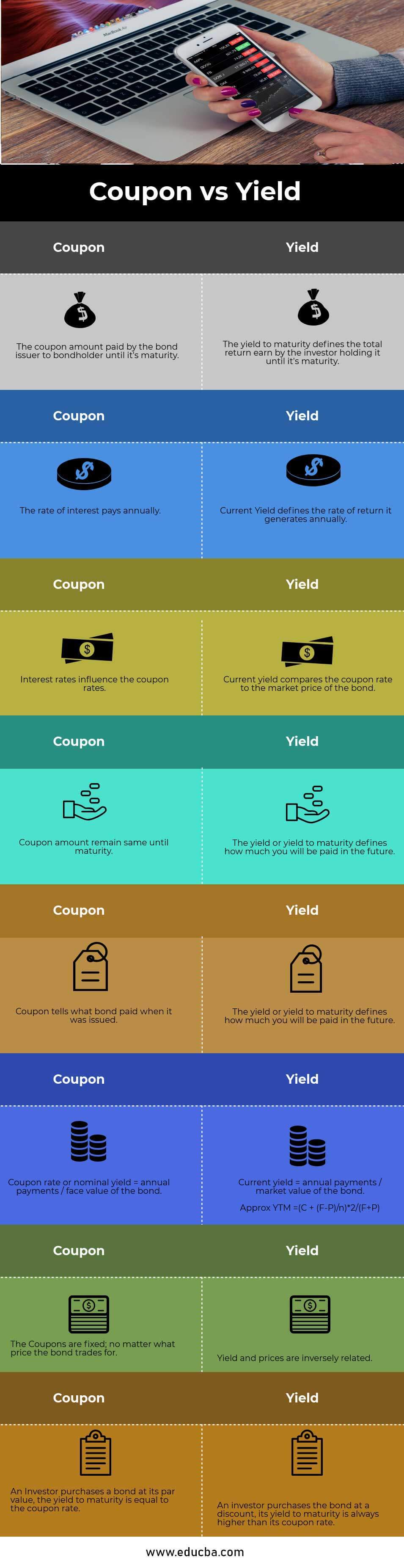

Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same... What is the difference between the YTM and the coupon rate? The coupon rate is the interest rate on the bond at the time of issue. The YTM or Yield to Maturity is the yield based on the current price of the bond. For example, if a $1000 bond maturing in 10 years is issued at 5%, then 5% is the coupon rate, which means it will always pay $50 per year until maturity.

Coupon rate vs ytm. Yield to Maturity vs. Coupon Rate: What's the Difference? Coupon Rate vs Yield to Maturity The difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value . In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. Difference between Coupon Rate And Yield To Maturity Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ... The Difference Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : 9

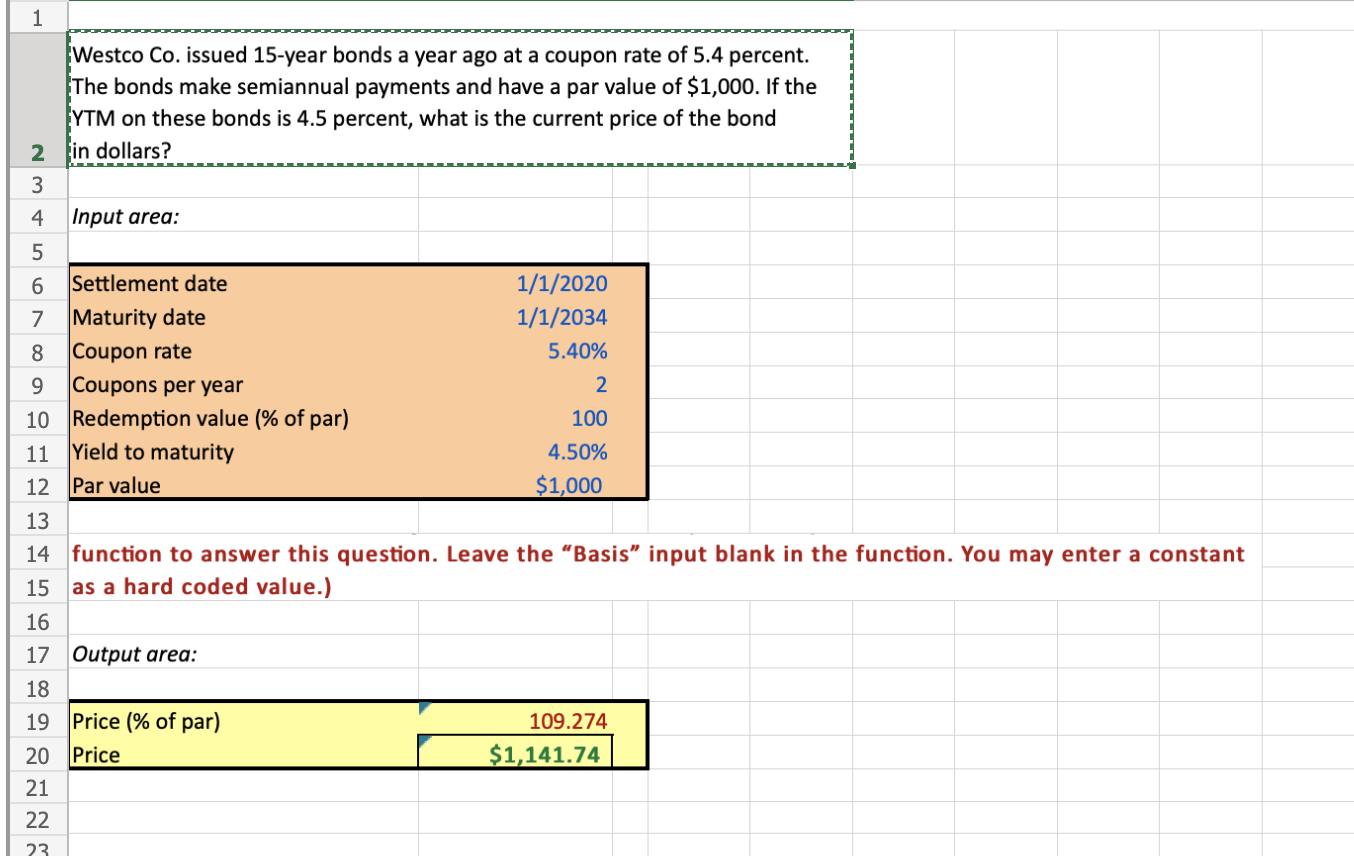

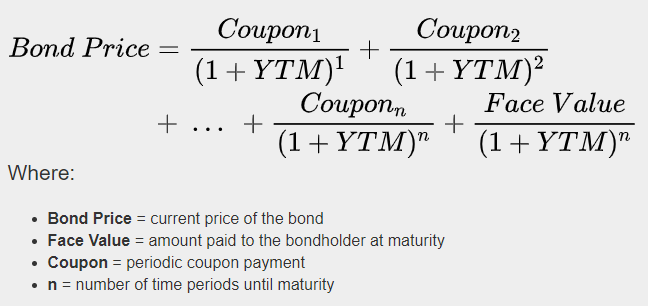

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We go through the coupon rate formula, current yield formula, and the yield to maturity formula. We also explain the difference between the face value and the market value of the bond and... Learn How Coupon Rate Affects Bond Pricing 11 Oct 2022 — Coupon Rate vs. Yield-to-Maturity ... The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield- ... Yield To Maturity(YTM): Meaning & Coupon Rate Vs YTM Vs Current Yield ... Coupon Rate Vs YTM Vs Current Yield. Before we move further, let us understand that when you purchase a bond, there are three things that are fixed, given below with examples-1.Face Value- Rs 1000. 2.Coupon Rate- 8%. 3.Maturity Period- 5 years. Yields can be measured in multiple ways, out of which 3 most common measures are- Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Coupon Rate Vs YTM - YouTube Learn more about the difference between a coupon rate and a yield to maturity.Investor's Business Daily has been helping people invest smarter results by pro... Difference Between Coupon Rate and Yield to Maturity Oct 21, 2022 · The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%.... Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

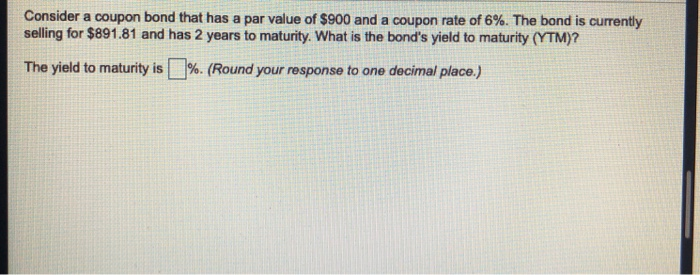

What is the difference between the YTM and the coupon rate? The coupon rate is the interest rate on the bond at the time of issue. The YTM or Yield to Maturity is the yield based on the current price of the bond. For example, if a $1000 bond maturing in 10 years is issued at 5%, then 5% is the coupon rate, which means it will always pay $50 per year until maturity.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same...

Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Post a Comment for "43 coupon rate vs ytm"