39 coupon rate for bonds

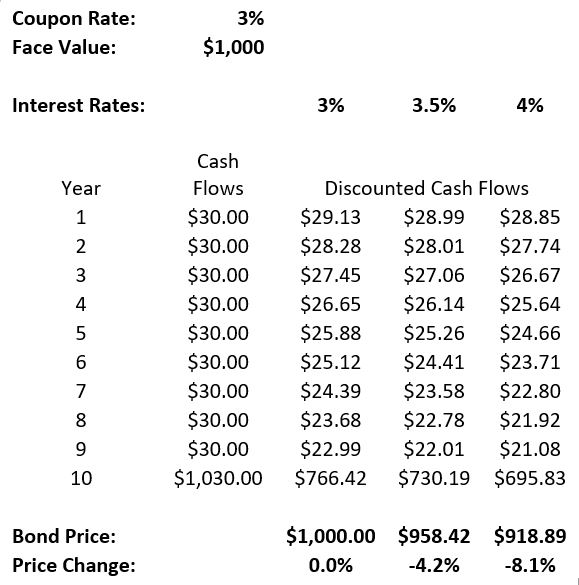

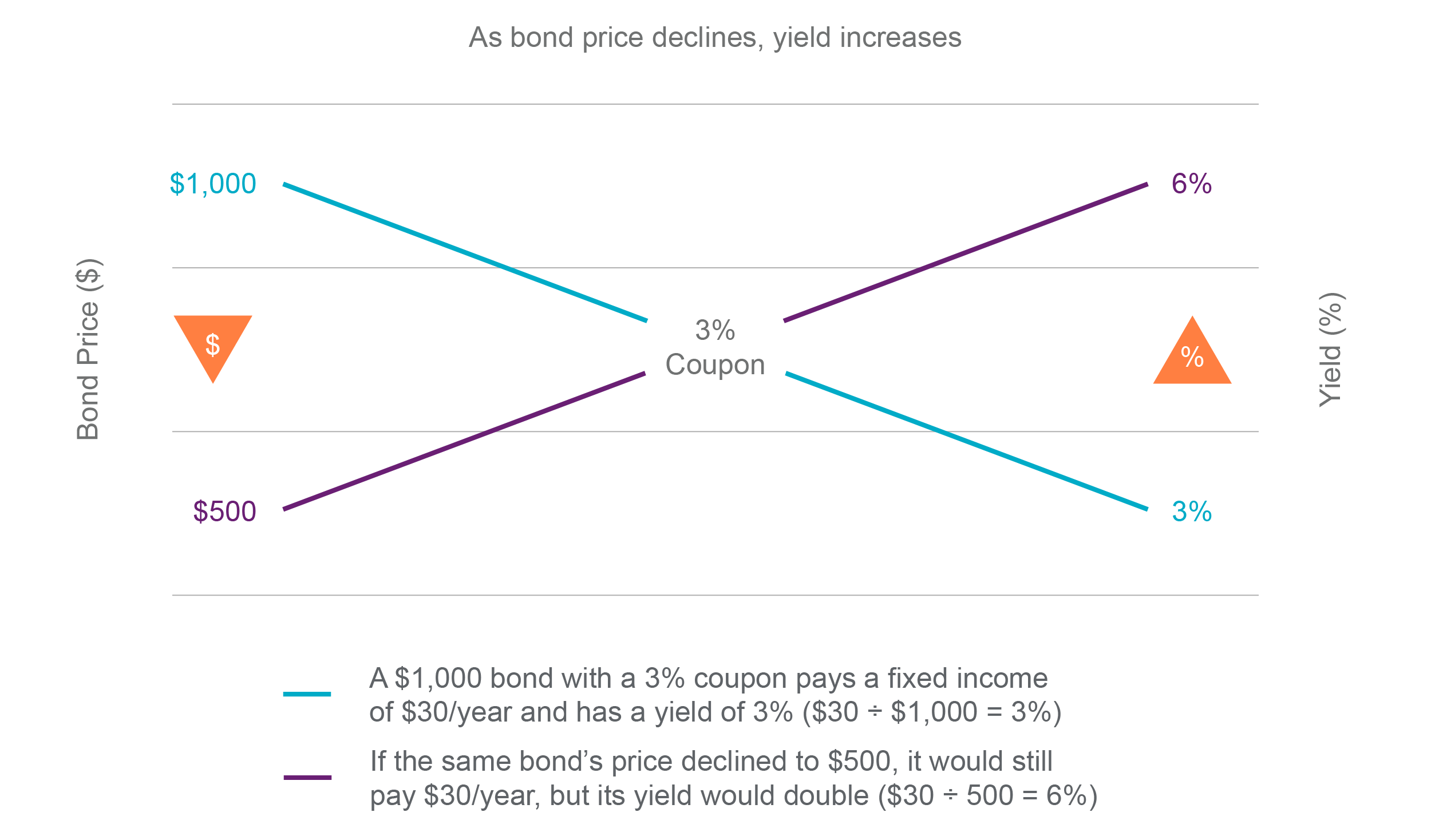

Coupon Rate: Formula and Bond Calculation (Step-by-Step) - Wall Street Prep Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Coupon rate for bonds

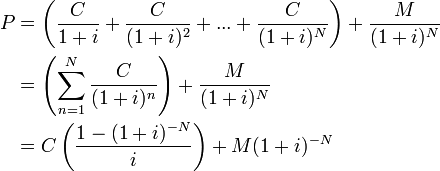

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

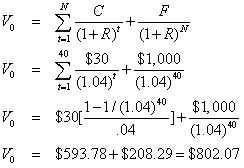

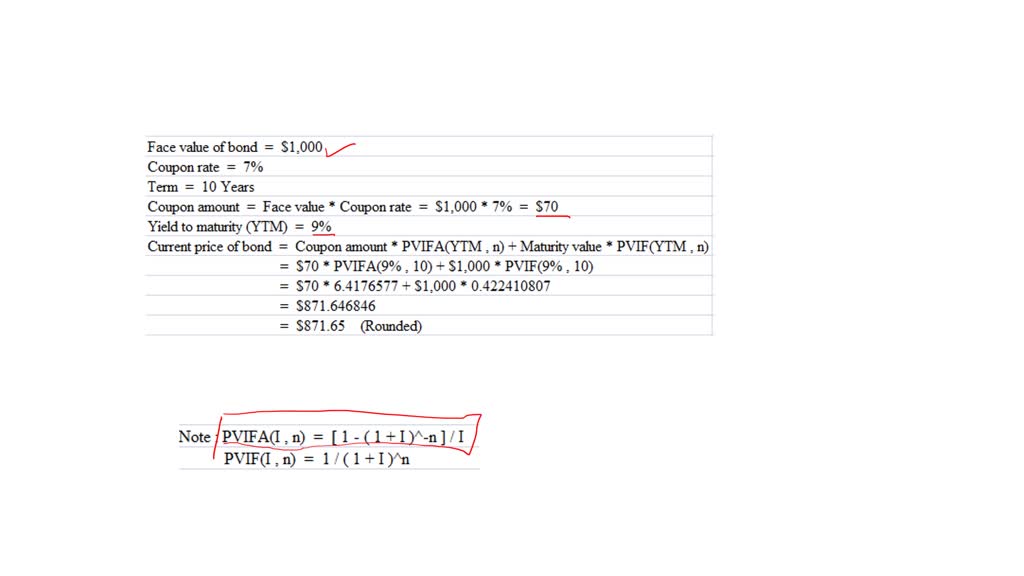

Coupon rate for bonds. Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. How to Calculate the Price of Coupon Bond? - WallStreetMojo Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The annual coupon rate for IBM bond is thus $20 / $1,000 or 2%. Fixed-Rate and Market Value . While the coupon rate of a bond is fixed, the par or face value may change. No matter what price the ...

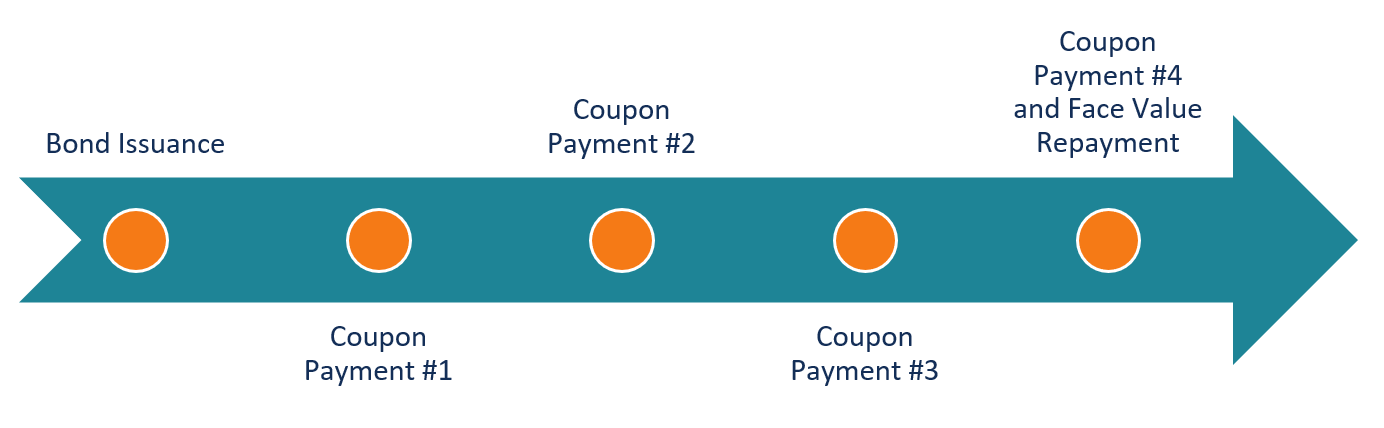

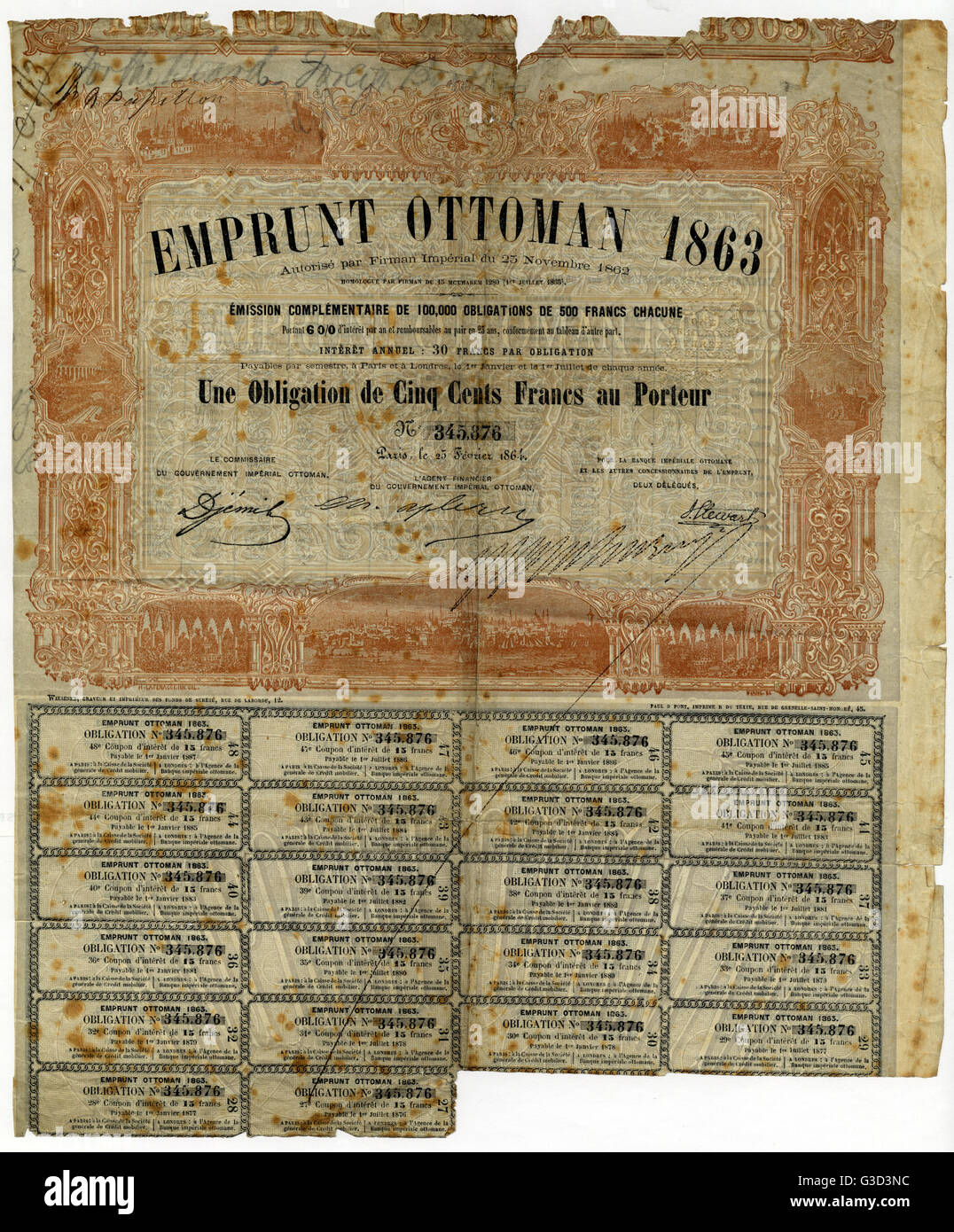

Coupon Bond - Investopedia Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Bond Coupon Rate Definition | Law Insider Related to Bond Coupon Rate. Coupon Rate has the meaning set forth in Section 2.8.. Bond Rate means, with respect to any Series or Class, the rate at which interest accrues on the principal balance of Transition Bonds of such Series or Class, as specified in the Series Supplement therefor.. Weekly Rate means an interest rate on the Bonds set under Section 2.02(a)(2).

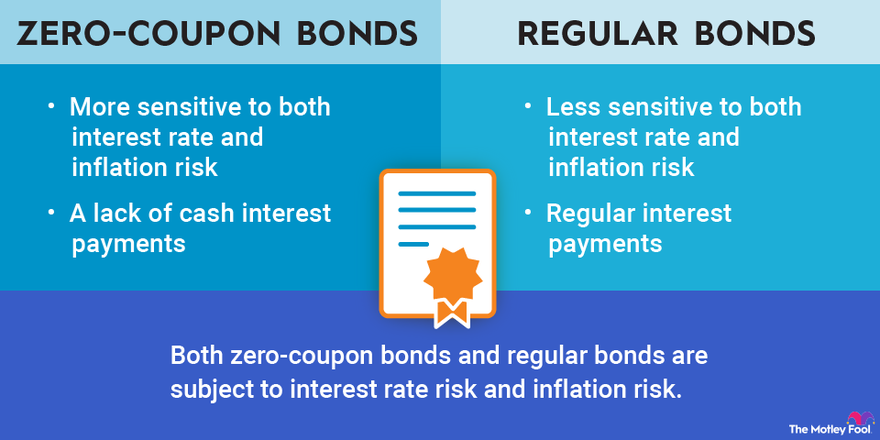

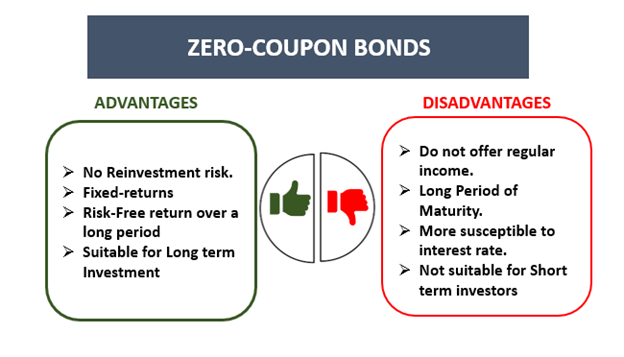

How To Find Coupon Rate Of A Bond On Financial Calculator How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year. What Is a Zero-Coupon Bond? - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 1.63: 100.26: 1.57%-41 +332: 1:27 PM:

Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity ...

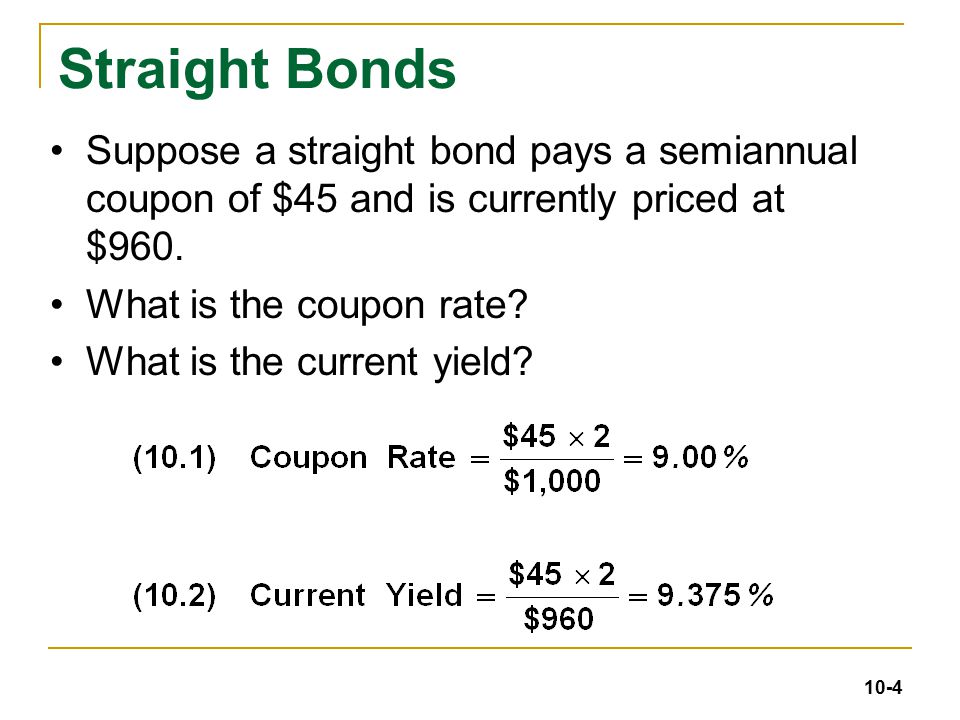

What Is the Coupon Rate of a Bond? - The Balance The coupon rate on a bond or other fixed income security is the stated interest rate based on the face or par value of the bond. The bond's yield is the dollar value of the annual interest payments as a percentage of the bond's current price. Investors can use a bond's coupon rate to benchmark the level of interest they will receive ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face ...

Post a Comment for "39 coupon rate for bonds"