44 yield to maturity of a coupon bond formula

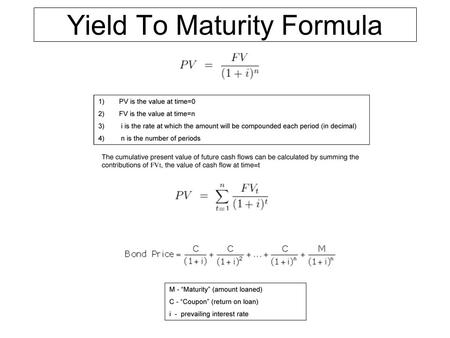

Bond Yield Calculator – Compute the Current Yield - DQYDJ Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula. Bond Yield Calculator How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow May 06, 2021 · Yield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity. ... Plug the yield to maturity back into the formula to solve for P, the price. Chances are, you will not arrive at the same value. ... where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M ...

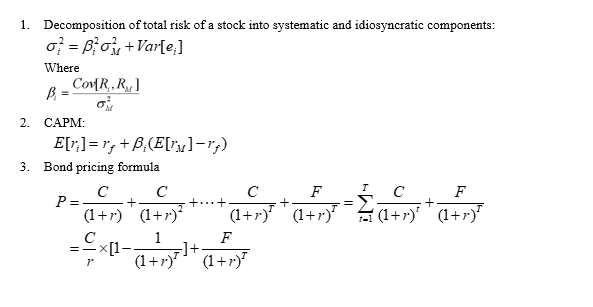

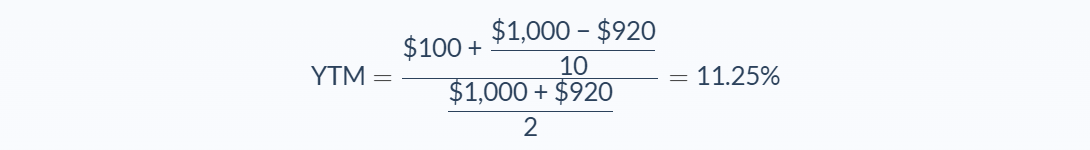

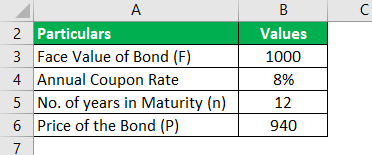

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

Yield to maturity of a coupon bond formula

Current Yield Formula | Calculator (Examples with Excel Template) - EDUCBA Therefore, the current yield of the bond is 5.26%. Current Yield Formula – Example #2. Let us take the example of a 10-year coupon paying a bond that pays a coupon rate of 5%. Calculate the current yield of the bond in the following three cases: Bond is trading at a discounted price of $990. Bond is trading at par. › bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond’s face value with the coupon rate. YTM: What is Yield to Maturity? - Wall Street Prep The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on ...

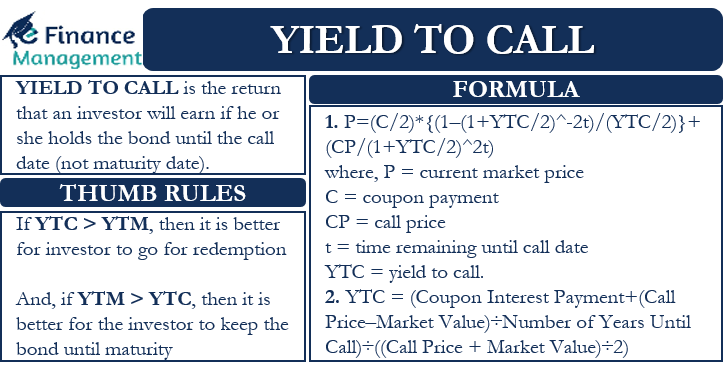

Yield to maturity of a coupon bond formula. Yield to Maturity (YTM) | Definition, formula and example Yield to maturity can also be calculated using the following approximation formula: YTM =. C + (F − P)/n. (F + P)/2. Where C is the annual coupon amount, F is the face value of the bond, P is the current bond price and n is the total number of years till maturity. Yield to Maturity (YTM) - Meaning, Formula and Examples - Groww The coupon rate of the bond remains fixed until maturity. What fluctuates is the price and the yield. So if a bond with a face value of Rs 2,000 has a coupon rate of 5%. Then, the coupon rate will stay so until maturity. The price may go up or down. ... If you look at the yield to maturity formula, you will see that the calculation of YTM ... Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · Yield to Maturity of Bonds . The YTM formula is a more complicated calculation that renders the total amount of return generated by ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ... › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

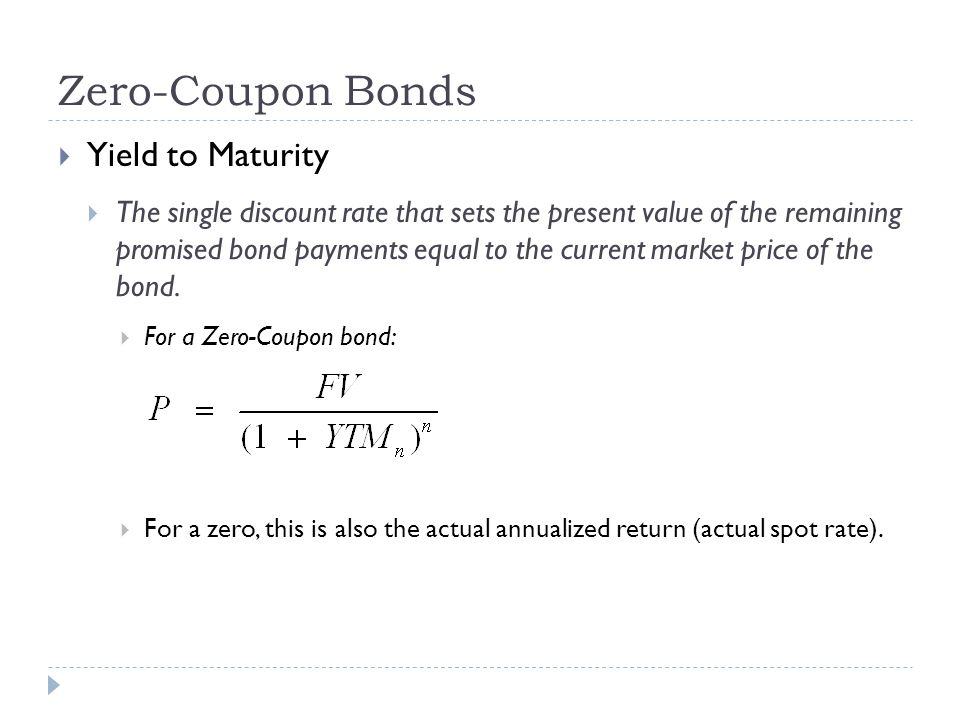

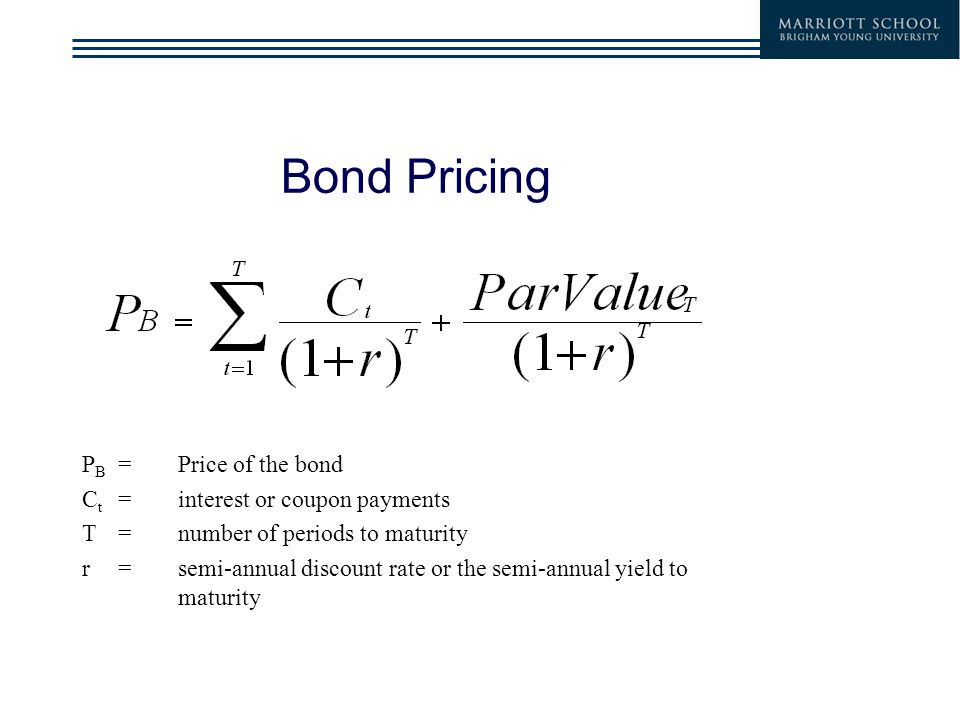

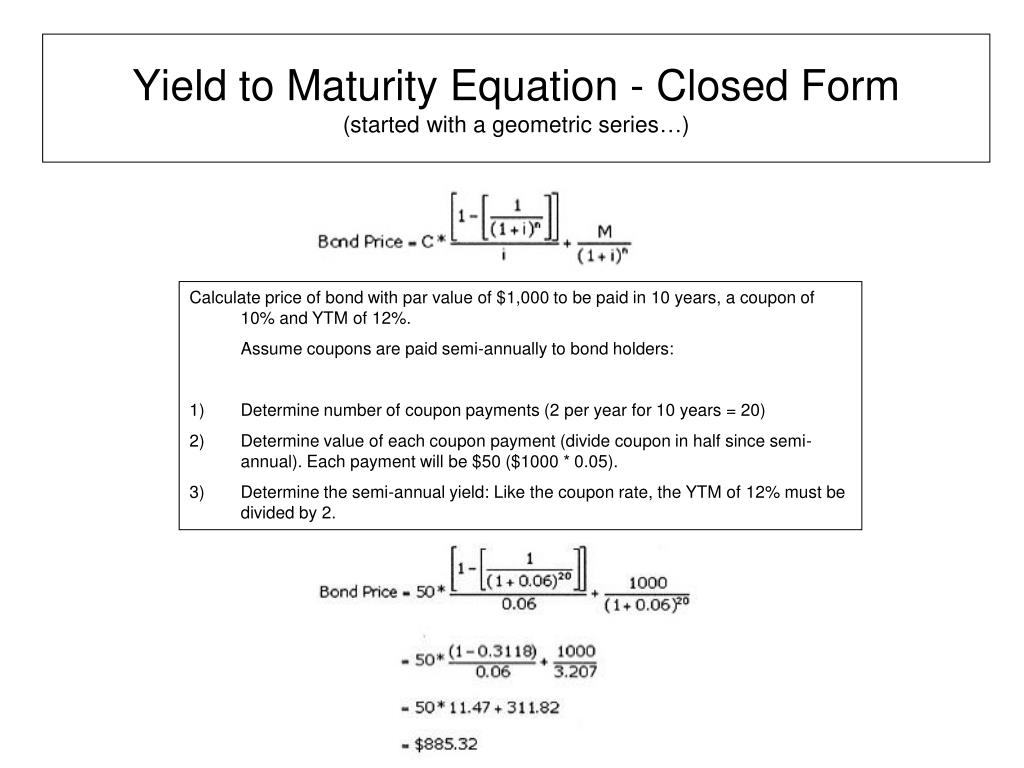

Yield to Maturity (YTM) Approximation Formula - Finance Train P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity. Let's take an example to understand how to use the formula. Let us find the yield-to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9 ... Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes › yield-to-maturity-ytmYTM: What is Yield to Maturity? - Wall Street Prep The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on ... Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM. Mathematically, the formula for bond price using YTM is represented as, Bond Price = ∑ [Cash flowt / (1+YTM)t] Where t: No. of Years to Maturity

EOF Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. Coupon Bond Formula | Examples with Excel Template - EDUCBA Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

› coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? Source: Coupon Bond Formula (wallstreetmojo.com) where. C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity YTM = Yield To Maturity The yield to maturity refers to the expected returns an investor anticipates after keeping the bond intact till the maturity date. In other words, a bond's returns are scheduled after making ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) Let's solve that for the problem we pose by default in ...

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Bond Yield Formula | Step by Step Calculation & Examples Bond Yield Formula = Annual Coupon Payment / Bond Price. Bond Prices and Bond Yield have an inverse relationship; When bond price increases, bond yield decreases. ... frequency of payment, and amount value at maturity. Step 1: Calculation of the coupon payment annual payment. Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual ...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Source: Coupon Bond Formula (wallstreetmojo.com) where. C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity YTM = Yield To Maturity The yield to maturity refers to the expected returns an investor anticipates after keeping the bond intact till the maturity date. In other words, a bond's returns are scheduled after making ...

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) Let's solve that for the problem we pose by default in ...

› ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · Yield to Maturity of Bonds . The YTM formula is a more complicated calculation that renders the total amount of return generated by ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ...

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked For eg:

Yield to Maturity - Approximate Formula (with Calculator) Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%. Example of YTM with PV of a Bond Using the prior example, the estimated yield to maturity is 11.25%.

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond...

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

YTM: What is Yield to Maturity? - Wall Street Prep The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on ...

› bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond’s face value with the coupon rate.

Current Yield Formula | Calculator (Examples with Excel Template) - EDUCBA Therefore, the current yield of the bond is 5.26%. Current Yield Formula – Example #2. Let us take the example of a 10-year coupon paying a bond that pays a coupon rate of 5%. Calculate the current yield of the bond in the following three cases: Bond is trading at a discounted price of $990. Bond is trading at par.

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Post a Comment for "44 yield to maturity of a coupon bond formula"