44 consider a bond paying a coupon rate of 10 per year semiannually when the market

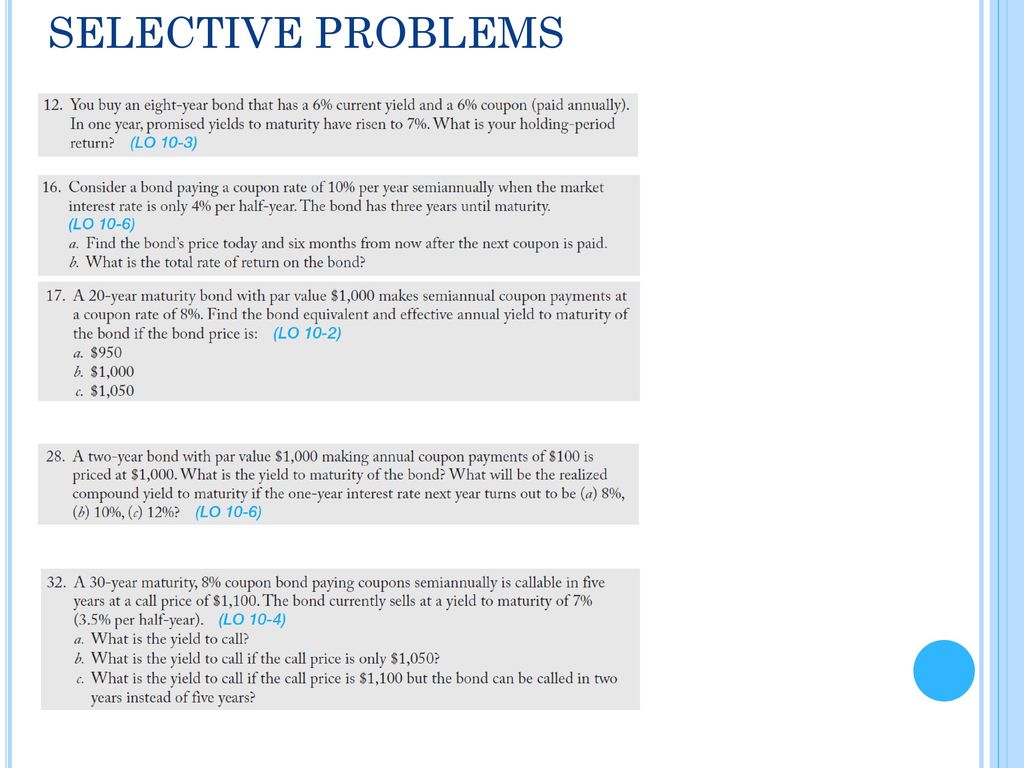

Consider a bond paying a coupon rate of 10 per year semiannually … 17.08.2019 · 16. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find … Investments Final Flashcards | Quizlet Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today. 1,000 FV, 50 PMT, 6 N, 4.25 I/Y CPT PV = 1,038.99805 Price = $1,039.00 YTM- Zero Coupon Bond

Solved > uestion Consider a bond paying a coupon rate:457084 ... Question Consider a bond paying a coupon rate of 9.75% per year semiannually when the market interest rate is only 3.9% per half-year. The bond has... Question Consider a bond (same as previous question) with $1000 par value, 13 annual coupon payments remaining, coupon rate of 6.8 percent, and yield to maturity... Question Consider a bond ...

Consider a bond paying a coupon rate of 10 per year semiannually when the market

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond? Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Solved Consider a bond paying a coupon rate of 10% per - Chegg See the answer Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expert Answer

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Solved Consider a bond paying a coupon rate of 10.50% per - Chegg Transcribed image text: Consider a bond paying a coupon rate of 10.50% per year semiannually when the market interest rate is only 4.2% per half-year. The bond has two years until maturity. … 1. Consider a bond paying a coupon rate of 10% per year...open 5 - Quesba 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond? 2. Solved 4. Consider a bond paying a coupon rate of 10% per - Chegg 4. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the … How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... › terms › fGuide to Fixed Income: Types and How to Invest - Investopedia Aug 31, 2022 · Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals and at reasonably predictable levels. Fixed-income investments can be used to ... Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the … When is a bond's coupon rate and yield to maturity the same? - Investopedia Defining the Coupon Rate, Maturity Date, and Market Value of Bonds . The coupon rate of a bond is its interest rate, or the amount of money it pays the bondholder each year, expressed as a ...

Yield to Maturity and Default Risk - Rate Return - Do Financial Blog Consider an 8% coupon bond selling for $953.10 with three years until maturity making annual coupon payments. The interest rates in the next three years will be, with certainty, r1 = 8%, r2 = 10%, and r3 = 12%. Calculate the yield to maturity and realized compound yield of the bond. 6. Finance Investments Chapter 10 HW - FINC 3440 - SU - StuDocu Consider a bond paying a coupon rate of 7% per year semiannually when the market interest rate is only 3% per half-year. The bond has six years until maturity. a. ** Find the bond's price today and six months from now after the next coupon is paid. ... 8% coupon bond paying coupons semiannually is callable in six years at a call price of $1,105 ... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... Solved Consider a bond paying a coupon rate of 10.25% per - Chegg Consider a bond paying a coupon rate of 10.25% per year semiannually when the market interest rate is only 4.1% per half-year. The bond has four years until maturity. a. Find the bond's price …

Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond’s price …

(Solved) - Consider a bond paying a coupon rate of 10% per year ... 1 Answer to Consider a ...

Answered: Consider a bond paying a coupon rate of… | bartleby Question Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Expert Solution

en.wikipedia.org › wiki › InterestInterest - Wikipedia Compare, for example, a bond paying 6 percent semiannually (that is, coupons of 3 percent twice a year) with a certificate of deposit that pays 6 percent interest once a year. The total interest payment is $6 per $100 par value in both cases, but the holder of the semiannual bond receives half the $6 per year after only 6 months (time ...

Bond selling price and yield maturity on the bond - BrainMass 4. Consider a bond paying a coupon rate of 6% per year semiannually (i.e. it pays $30 every six months) when the market interest rate at all maturities is only 2.5% per half year. The bond has three years until maturity. a. What is the bond's price today? First, you need to find the appropriate selling price by using the following formula. 0.025

› terms › pPro Rata: What It Means and the Formula to Calculate It Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ...

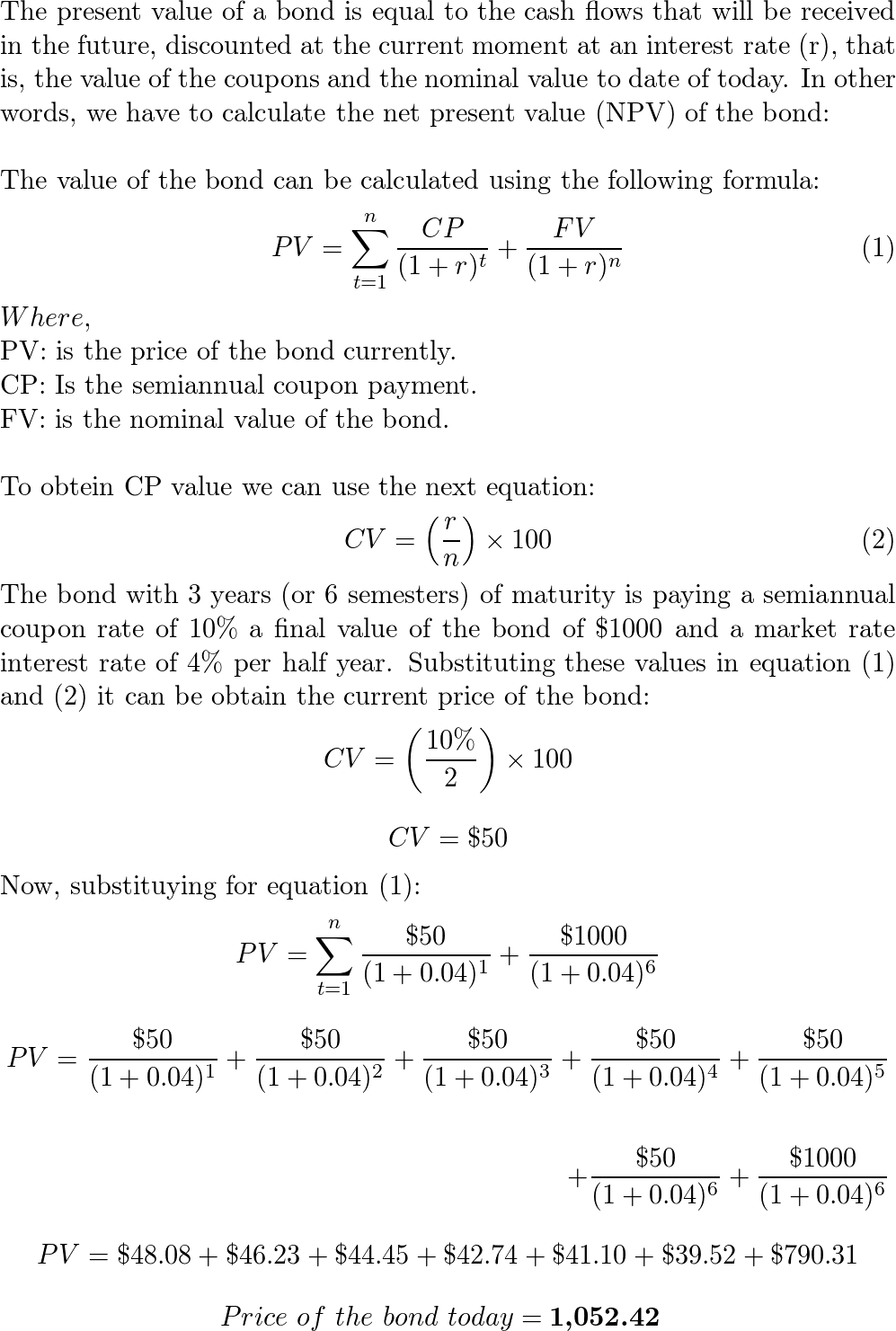

1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find the bond's price today and six months from now after the next coupon is paid.

› learn › storyBonds vs. Bond Funds: Which is Right for You? | Charles Schwab Since bond mutual funds and ETFs own many securities, the impact of one bond default would likely be less than for an individual investor owning individual bonds. While some bond investments may be made in denominations as low as $1,000 per bond, the appropriate amount to invest is best determined by an individual's investing goals and objectives.

› questions-and-answers › onAnswered: On January 1, 2022, Broncos Universal… | bartleby Jan 01, 2022 · The bonds mature in10 years. For bonds of similar risk and maturity, the market yield is 10%. Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2022. 2. Prepare the journal entry to record the bond issuance on January 1, 2022. 3.

Consider a bond paying a coupon rate of 12.25% per - SolutionInn Consider a bond paying a coupon rate of 12.25% per year semiannually when the market interest rate is only 4.9% per half-year. The bond has six years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b.

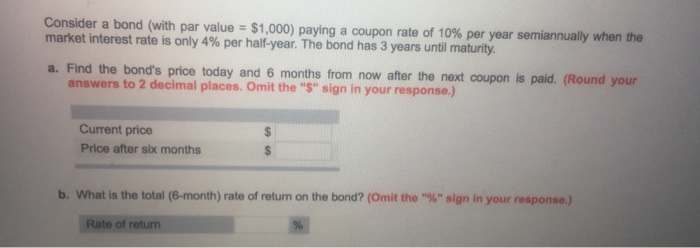

Consider a bond (with par value = $1,000) paying a coupon rate of 8% ... Consider a bond (with par value = $1,000) paying a coupon rate of 8% per year semiannually when the market interest rate is only 6% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.)

› what-are-bonds-and-howWhat Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · This is the annual interest rate paid by the bond issuer, based on the bond’s face value. These interest payments are usually made semiannually. Issue date: The issue date is the date on which a bond is issued and begins to accrue interest. Maturity date: The date on which you can expect to have your bond's principal repaid. It is possible to ...

1. Consider a bond paying a coupon rate of 10% per year...get 5 28.12.2021 · 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find …

(Get Answer) - Consider a bond paying a coupon rate of 9.25% per year ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is... Posted one year ago View Answer Recent Questions in Investment Q:

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change.

Solved Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the …

Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

[Solved] Consider a bond paying a coupon rate of 10% per year ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Coupon

OneClass: Consider a bond paying a coupon rate of 10% per year ... 28 Sep 2019 Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b.

Solved Consider a bond paying a coupon rate of 10% per - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond’s six …

Answered: Consider a bond paying a coupon rate of… | bartleby Business Finance Q&A Library Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond's price today and 6 months time after the next coupon is paid?

Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%. The bond has 3 years until maturity. a. Find the bond price today and six months from now after the next coupon is paid, assuming the market rate will be constant during the following 6 months. b.

› questions-and-answersAnswered: Amalgamated General Corporation is a… | bartleby The market price of the Millwork Ventures Company common stock was $27.00 per share and $14.00 per share for the NXS Corporation common stock. The fair values of the bond investments were $58.9 million for Household Plastics Corporation and $16.5 million for Holistic Entertainment Enterprises.

Consider a bond paying a coupon rate of 10 per year semiannually when ... The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year.

Bond Price, Rate of Return, Yield to Maturity - BrainMass 7. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three year until maturity. (a) Find the bond's price today and six months from now after the next coupon is paid. (b) What is the total (six month) rate of return on the bond? 8.

Consider a bond paying a coupon rate of 10% per year semiann - Quizlet Find step-by-step Economics solutions and your answer to the following textbook question: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid..

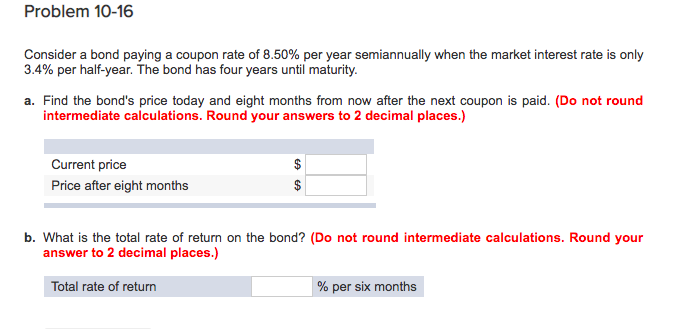

OneClass: Problem 10-16 Consider a bond paying a coupon rate of 8. Problem 10-16 Consider a bond paying a coupon rate of 8.50% per year semiannually when the market interest rate is only 3.4% per half-year. The bond has four years until maturity. a. Find the bond's price today and eight months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Solved Consider a bond paying a coupon rate of 10% per - Chegg See the answer Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expert Answer

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond?

Post a Comment for "44 consider a bond paying a coupon rate of 10 per year semiannually when the market"