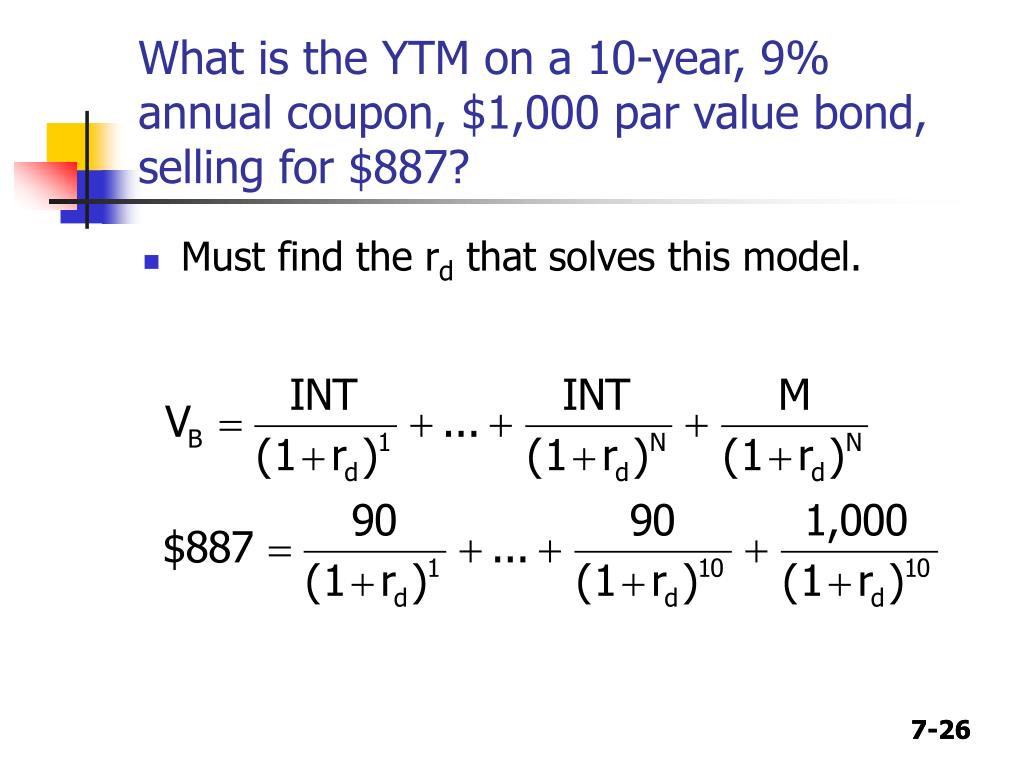

41 a 10 year bond with a 9 annual coupon

[Solved] A 10-year bond with a 9% annual coupon has a yield to maturity ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d. Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

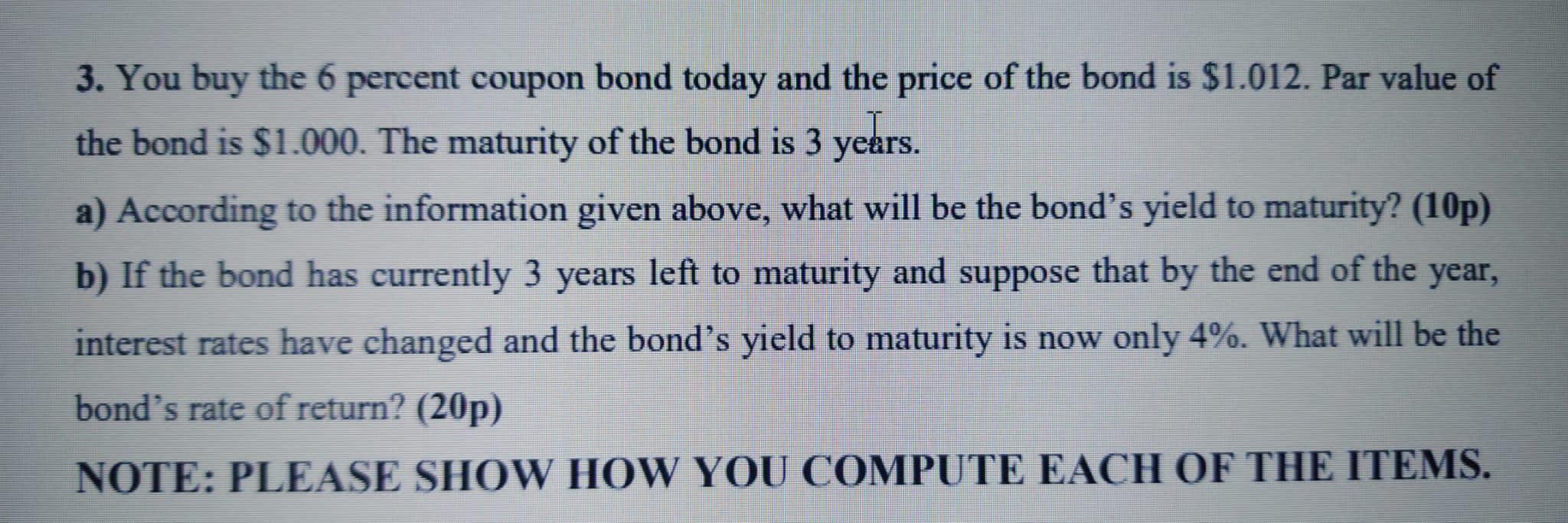

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

A 10 year bond with a 9 annual coupon

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price ? a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual couponhas a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d. Chapter 7 Homework Finance Flashcards - Quizlet You hold two bonds, a 10-year, zero coupon, issue and a 10-year bond that pays a 6% annual coupon. The same market rate, 6%, applies to both bonds. If the market rate rises from its current level, the zero coupon bond will experience the larger percentage decline. b. The time to maturity does not affect the change in the value of a bond in ...

A 10 year bond with a 9 annual coupon. Solved A 10-year bond with a 9% annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its A 10-year bond with a 9% annual coupon has a yield to...ask 5 A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value. b. the bond is selling at a discount. c. the bond will earn a rate of return greater than 8%. d. the bond is selling at a premium to par value A 10 year annual coupon bond was issued 4 years ago at par. Since then ... A 10 year annual coupon bond was issued 4 years ago at par. Since then the bond's yield to maturity (YTM) has decreased from 9% to 7%.. 1. A chapter5practicetest.docx - A 10-year bond with a 9% annual coupon has ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Select one: a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value. c. The bond is selling at a discount. d.

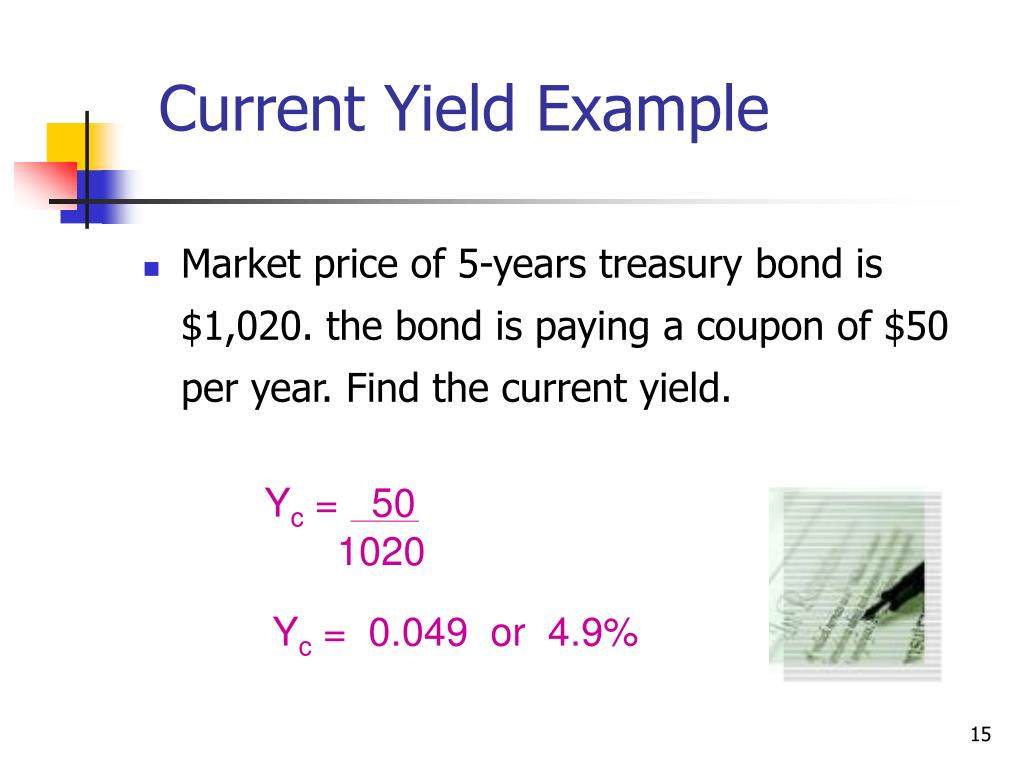

A 20-year, $1000 par value bond has a 9% semi-annual ... Answer to A 20-year, $1000 par value bond has a 9% semi-annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current. Consider a 7 year bond with a 9 coupon and a present 10 . A bond pays a semi-annual coupon and the last coupon was paid 74 days ago . If the annual coupon payment is $ 65 , what is the accrued interest ? ... a 10 year bond with a 9% coupon. A ) a 30 year bond with a 10 % coupon. A bond with longest maturity and highest coupon rate will have the longest duration. Hence, a 30 year bond with 10% ... Answered: 7) Consider a 10-year 10% annual coupon… | bartleby A: Given, The price of bond is $1065.95 Life of bond is 9 years Yield to maturity is 7%. question_answer Q: Which of the following statements are true about unsecured bonds? Interest Rates and Bond Valuation and annual coupons. ... 10 year maturity, 8% coupon rate, $1,000 par value ... 9. CURRENT YIELD VS. YIELD TO. MATURITY. • Current Yield = annual coupon / ...

Question 12 a 10 year bond with a 9 annual coupon has Question 12 A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Selected Answer: If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. 21 A 10 year bond with a 9 annual coupon has a yield to ... 22.A Treasury bond has an 8% annual coupon and a 7.5% yield to maturity.Which of the followingstatements is CORRECT? 3. A 10-year corporate bond has an annual coupon of 9%. The… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue

[Solved] A 10-year $1,000 par value bond has a 9% semiannual coupon and ... A 10-year $1,000 par value bond has a 9% semiannual coupon and a nominal yield to maturity of 8.8%. What is the price of the bond? Coupon A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. The formula is: Here P is the amount annually paid i.e. 80 (assuming nominal value of $1000), r is the required rate of return i.e. 7%(not coupon rate of 8%) and n is 10 years. Also, the above formula consid...

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

A 10-year corporate bond has an annual coupon of 9%. The bond… A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT CORRECT? Answer a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. If the bond's yield to maturity remains constant ...

Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond's yield to maturity?

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

A 10 year bond with a 9 annual coupon has a yield to - Course Hero A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * 1/1 a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value. c. The bond is selling at a discount. d.

FINN 3226 CH. 4 Flashcards - Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

What is the value of a 10-year, $1,000 par value bond with a 10 percent ... The value is 1.145062 Now 0.145062 is the annual increase per ₹1. For ₹100 it is ₹14.5062. The annualised yield is 14.5062%. If you have another investment on another date, and the value for 50000 is 49200 say after 20 days, find the value of (49800÷50000)^ (365÷20)= 0.9295. The yield is negative, 1 - 0.9295=- .0705, per ₹1. For 100 it is -7.05.

Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has an 8 percent yield to maturity. Which of the comments below is the most accurate?a. The bond is being sold at a reduced price.b. The current yield on the bond is greater than 9%.c. If the yield to maturity is stable, the bond's price would be lower one year from now than it is now.d.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ...

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved!

Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond s yield to maturity?

Chapter 7 Homework Finance Flashcards - Quizlet You hold two bonds, a 10-year, zero coupon, issue and a 10-year bond that pays a 6% annual coupon. The same market rate, 6%, applies to both bonds. If the market rate rises from its current level, the zero coupon bond will experience the larger percentage decline. b. The time to maturity does not affect the change in the value of a bond in ...

a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual couponhas a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

Post a Comment for "41 a 10 year bond with a 9 annual coupon"