38 bond yield vs coupon rate

Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis Yield can be different than coupon rates based on the principal price of the bond. If the price is par at time of purchase and you receive par at maturity, then the yield and coupon will be the same. For instance, say a bond at issuance is priced at 100 with 10% coupons. You pay 100 initially and receive 10% coupons over the life of the bond. Explaining Yields vs Coupon rate of Bonds - Orb52 But when the Price of the bond fell to ₹9500, then even in such a situation the interest that will be received is still ₹1,000. Hence in such case, the actual returns will be ₹1,000/₹9,500 = 10.52% and this is called the Yield on the Bond. In such case, the decrease in the price resulted in the increasing of the Yield of the Bond.

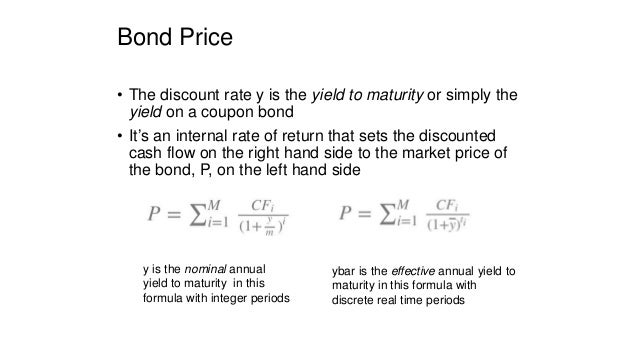

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays ...

Bond yield vs coupon rate

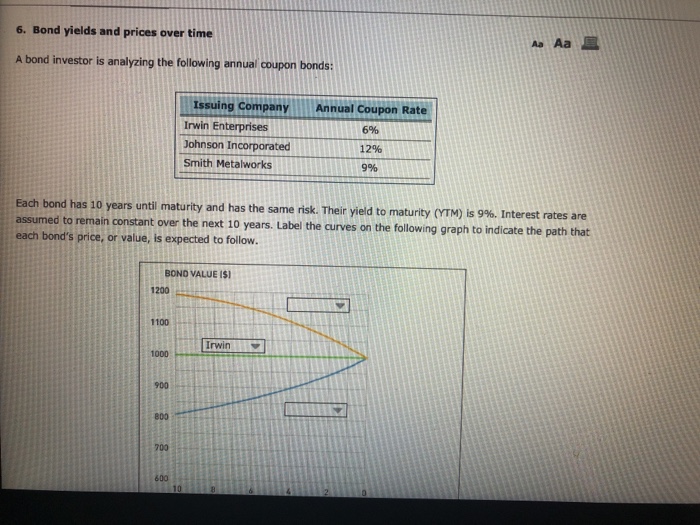

Bond yield vs coupon rate: Why is RBI trying to keep yield down? Coupon rate is declared on the face value of a bond and remains the same for the entire issue period of the bond. For example, if the coupon rate of a 10-year bond of face value of Rs 1,000 is 6 ... Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. ... Yield to maturity will be equal to coupon rate if an investor purchases ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Coupon Rate vs. Yield-to-Maturity. The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when ...

Bond yield vs coupon rate. What is the difference between coupon and yield? - Quora Answer (1 of 3): Coupon is the annual interest rate paid to bondholders. Yield is a measure of return based on coupon, purchase price, and maturity. Example: XYZ 4.00% bonds are due OCT 1 2028 trade at par ($100-00) At this price, the coupon rate 4.00% is equal to the Yield to maturity. * We... How are bond yields different from coupon rate? - The F The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the ... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

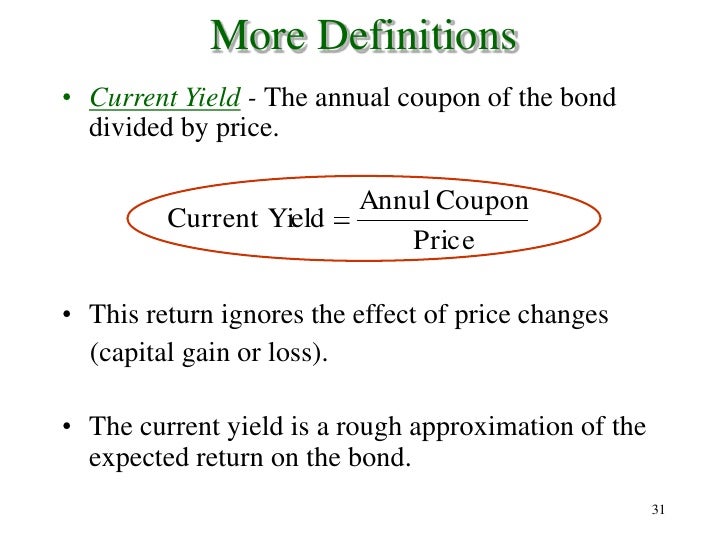

Difference Between Current Yield and Coupon Rate (With Table) The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same. The Current Yield can be calculated by taking the ratio of annual cash payment and the market price of the bond. On the other hand, the Coupon Rate is calculated by taking the percentage ratio of coupon payment to ... Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis The coupon rate of a bond represents the amount of actual interest that is paid out on a bond relative to the principal value of the bond (par value). Finding the coupon rate is as simple as dividing the coupon payment during each period divided by the par value of the bond. This is often referred to as the stated rate. Bond Yield: Formula and Calculator [Excel Template] Bond Current Yield Calculation. For our first returns metric, we'll calculate the current yield by multiplying the coupon rate (%) by the par value of the bond ("100"), which is then divided by the current bond quote. Current Yield = (Coupon Rate * Par Value) / Bond Quote. Current Yield - Discount: 9.44%. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ... Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy Peasy ... - YouTube This video addresses "Coupon Rate vs Yield" for a Bond in a simple, kid-friendly way. PLEASE SUBSCRIBE (It's FREE!): ... What Is Coupon Rate and How Do You Calculate It? Coupon Rate vs. Yield. While coupon rate is the percentage that a bond returns based on its initial face value, yield refers to a bond's return based on its secondary market sale price. It is what the bond is worth to its current holder. When the current holder is the initial purchaser of the bond, coupon rate and yield rate are the same.

Difference between Coupon Rate And Yield To Maturity The primary difference between coupon rate and yield to maturity is that the coupon rate stays the same throughout the tenure of the bond. However, the yield to ...Face value: 10%

Interest Rates And Bond Pricing - BrandNew Swimwear Bond Yield Rate Vs Coupon Rate: What's The Difference? The SPV pledges its assets as collateral for the benefits of noteholders to secure its repayment obligations. Many securitizations provide for significant principal amortization ahead of the expected maturity, which may mitigate risk of loss without any investor action or hedging. Credit ...

Difference Between Bond Yield and Coupon Rate (With Table) The main difference between Bond Yield and the Coupon rate is that Bond Yield is the return rate, whereas the Coupon Rate signifies the rate of interest to be ...Formula: The Bon Yield is calculated by the for...Mutual Relation: If a bond is purchased at a re...

Understanding Bond Prices and Yields - Investopedia The same holds true for bonds priced at a discount; they are priced at a discount because the coupon rate on the bond is below current market rates. Yield Tells (Almost) All A yield relates a bond ...

Difference Between Coupon Rate and Yield of Maturity The rate of interest is paid annually at a coupon rate. The current Yield defines the rate of return it generates annually. 3; Interest rate fluctuates in the coupon rate. The current yield compares the coupon rate to the market price of the bond. 4; The coupon amount remains the same till its maturity.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond(at par). While yield to maturity defines that it's ...4: The coupon amount remains the same until ...5: Coupon tells what bond paid when it was is...1: The coupon amount paid by the bond issuer ...7: The Coupons are fixed; no matter what price ...

Post a Comment for "38 bond yield vs coupon rate"