39 what is bond coupon rate

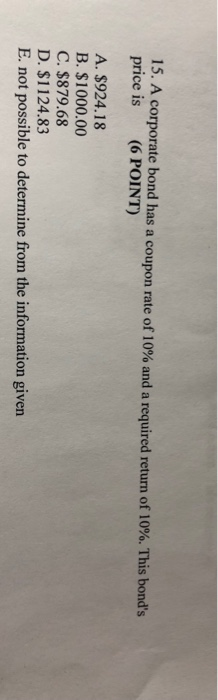

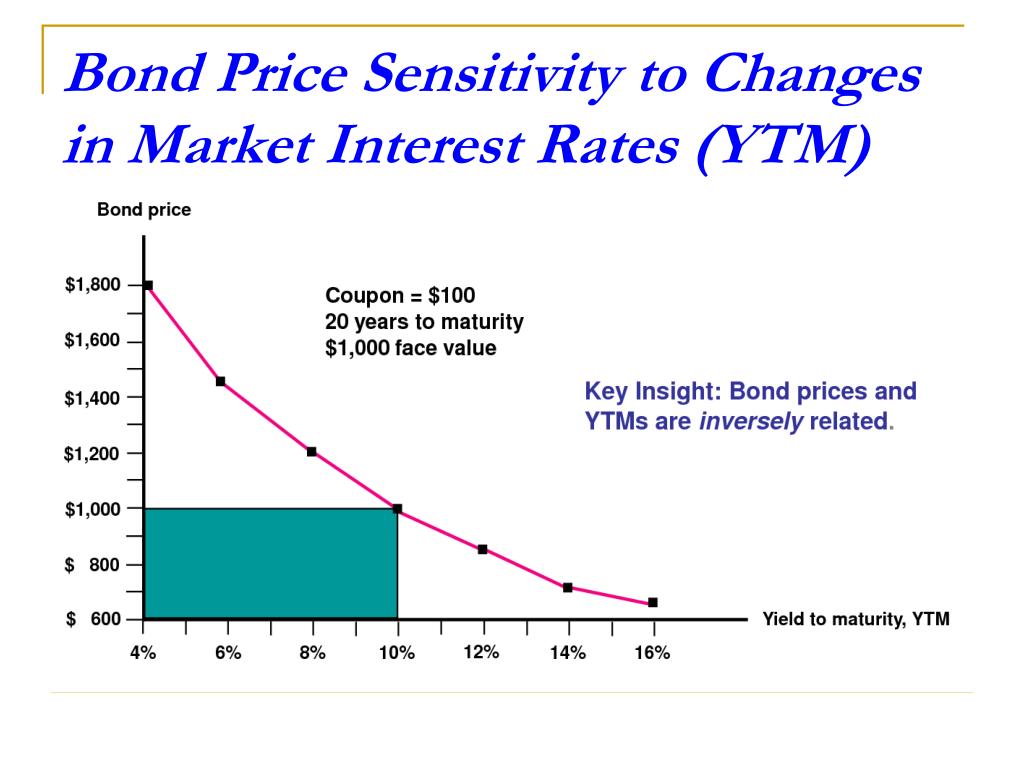

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... A bond is priced at a discount below par value when the coupon rate is less than the market discount rate. All else equal, the price of a lower-coupon bond is more volatile than the price of a higher-coupon bond. Relationship with maturity What Is a Coupon Rate? How To Calculate Them & What They're Used For A bond's coupon rate shows you how much interest the bond issuer pays the bondholder annually. Therefore, this rate is measured as a percentage of bond par value (face value). For instance, assume a $2,000 bond has a face value of $2,000 and a coupon rate of 2%, this means that $40 (that is 2% of $2,000) will be paid to the bondholder each year till its maturity.

What Is a Coupon Rate? And How Does It Affects the Price of a Bond? Coupon rate = $500 / $1,000 = 0.05 The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. How the Coupon Rate Affects the Price of a Bond? Every type of bonds does pay interest to bondholder. Such amount of interest is called coupon rate of interest. The coupon rate is fixed over time.

What is bond coupon rate

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates are the static variable in a dynamic bond market. This makes them an important variable in establishing market rates. The Inverse Relationship Between Price and Yield As bond prices fluctuate and coupon rates stay the same, the yield of a bond changes. This is an extremely important consideration because it changes the value of a bond. › terms › cWhat Is a Coupon Bond? - investopedia.com Mar 31, 2020 · A coupon bond is a debt obligation with coupons attached that represent semiannual interest payments, also known as a "bearer bond." ... the coupon bond simply refers to the rate it projects ... What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

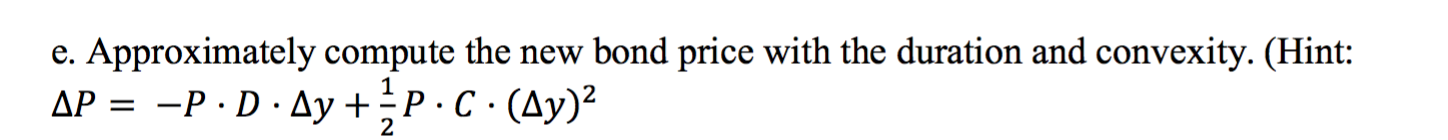

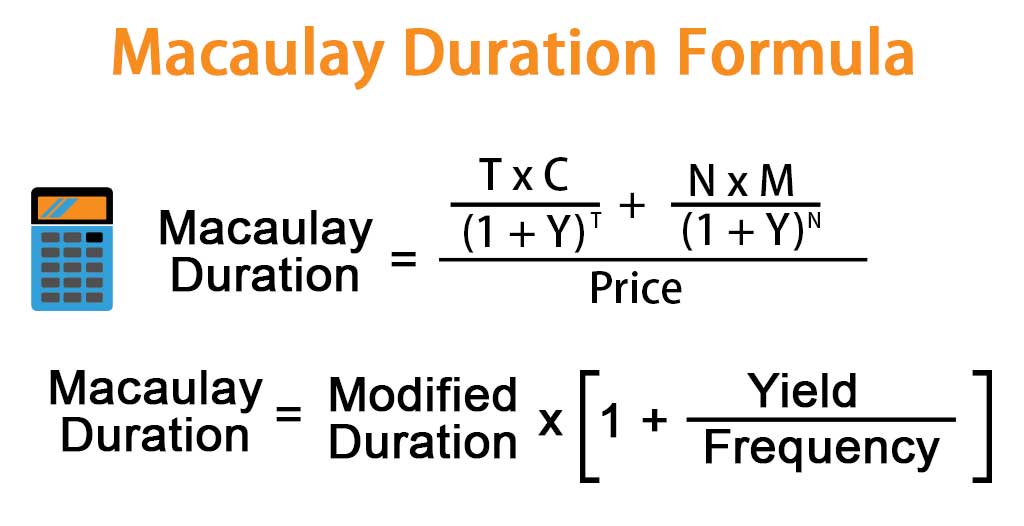

What is bond coupon rate. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. What Is Coupon Rate and How Do You Calculate It? It is not based on subsequent trading. A bond coupon rate is a fixed payment, meaning that it will remain the same for the lifetime of the bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%. Every year, the bond will pay you 5% of its value, or $5, until it expires in a decade. That active payment occurs on a fixed basis, usually twice a year. Bond's Duration and Managing Interest Rate Risk The coupon rate, the time to maturity and yield to maturity are the factors which determine a bond's duration. Most Important Properties of Duration (Bodie et al. 2012) Rule 1: The duration of a zero-coupon bond equals its time to maturity (Figure 7). Floating Rate Bonds: Characteristics, Rate, and Important For example, if the Fed rate is 1.25%, the issuer will add a margin or quoted interest rate of 0.25% and the floating rate would become 1.50%. As the Fed or LIBOR changes with economic conditions and government policies, the total floating interest rate offered on these bonds fluctuates. Characteristics of Floating Rate Bonds:

Coupon Rate - Meaning, Calculation and Importance The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Answered: What is the purchase price for a bond… | bartleby NA. NA. What is the purchase price for a bond that is paying 6 percent annual coupon rate in Semi-annual payments if its Yield to Maturity is 10 % and it has 10 years and 10 months from its purchase date until its maturity? What is the accrued interest rate? Assume the bond is traded in a year of 366 days when calculating the accrued interest. › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) Thus Cube Bank will pay $463.19 and will receive $1000 at the end of 10 years, i.e., on the maturity of the Zero Coupon Bond, thereby earning an effective yield Effective Yield Effective yield is a yearly rate of return at a periodic interest rate proclaimed to be one of the effective measures of an equity holder's return as it takes ... › 5933336 › calculate-annual-rateHow to Calculate the Annual Rate of Return on a Bond Determine how much interest you earned on the bond during the year by multiplying its face value by its coupon rate. For example, if you have a $1,000 bond with a coupon rate of 4 percent, you'd earn $40 in interest each year. Calculate how much the value of the bond appreciated during the year. Look at how much the bond was selling for on ...

Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

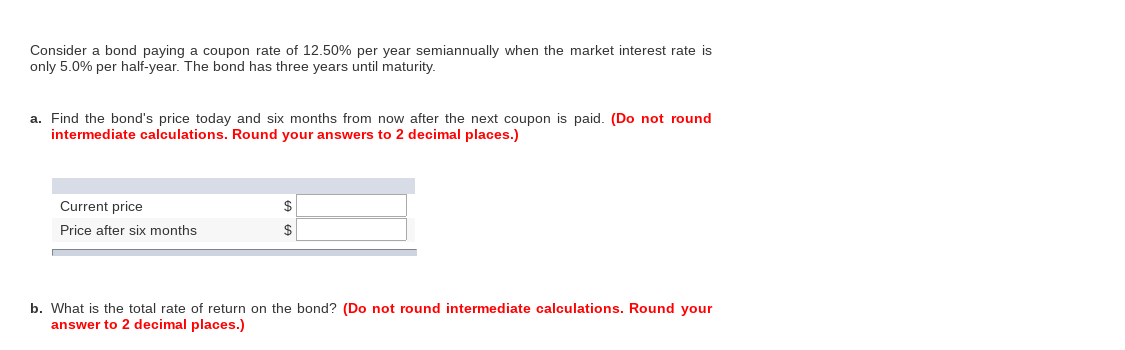

How to Calculate the Price of Coupon Bond? - WallStreetMojo Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2 Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons.

Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate , which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon = 0.09 X 500.00 = USD 45.00. This means that bondholders of this bond will get USD 45.00 every year up until 2024 i.e. year of maturity. The tricky thing is the coupon rate of a bond also affects the price of the bonds in the secondary market. The bonds price is sensitive to the coupon rate. At this point, we can discuss the different ...

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Difference Between Coupon Rate and Discount Rate (With Table) Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond.

Difference Between Coupon Rate and Yield of Maturity A coupon rate is a rate at which the interest payment of a bond is made to the investor. It represents the yearly interest rate paid by the bond with respect to its face value denoted as a percentage.

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

› gold-rate › sovereign-goldSovereign Gold Bond - Schemes, Price, Returns, Interest Rate 2020 Apr 28, 2021 · The tenor of the SGBs is 8 years. However, one can also encash/ redeem the bond after 5th year from the date of issue on coupon payment dates. On maturity: The investor will be advised one month before maturity. On maturity, the gold bonds will be redeemed in Indian rupees based on the selling price published by the Indian Bullion and Jewelers ...

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

› terms › cCoupon Rate Definition Sep 05, 2021 · The coupon rate is the interest rate paid on a bond by its issuer for the term of the security. The term "coupon" is derived from the historical use of actual coupons for periodic interest payment ...

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

Capital gains yield formula excel - animadigomma.it To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (e. Assign the formula =AVERAGE (C3:C8). 25%. Add yearly interest to capital gain to get the annual return. The result should be 0. The IRR is influenced by the timing of capital calls and distributions, and ...

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

› terms › cWhat Is a Coupon Bond? - investopedia.com Mar 31, 2020 · A coupon bond is a debt obligation with coupons attached that represent semiannual interest payments, also known as a "bearer bond." ... the coupon bond simply refers to the rate it projects ...

Post a Comment for "39 what is bond coupon rate"