44 coupon rate semi annual

Coupon Rate of a Bond (Formula, Definition ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, What Is Coupon Rate and How Do You Calculate It? Coupons can save you money on double stuffed Oreo cookies. They can make skee-ball seem like a good use of time. And they can help you save for retirement or college tuition. A bond with semi-annual to annual coupon payments can provide a steady stream of income with the right coupon rate.

3 Ways to Calculate Annual Interest on Bonds - wikiHow 29.03.2019 · To calculate the annual interest, you need to know the coupon rate and the price of the bond. For example, Company QRS issues 5-year, $500,000, 10 percent bonds, with interest paid semi-annually. The market interest rate is 10 percent, so the bond is issued at par.

Coupon rate semi annual

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Coupon Rate Calculator. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Buying a $1,000 Bond With a Coupon of 10% - Investopedia Most bonds pay interest semi-annually, which means bondholders receive two payments each year. 1 So with a $1,000 face value bond that has a 10% semi-annual coupon, you would receive $50 (5% x...

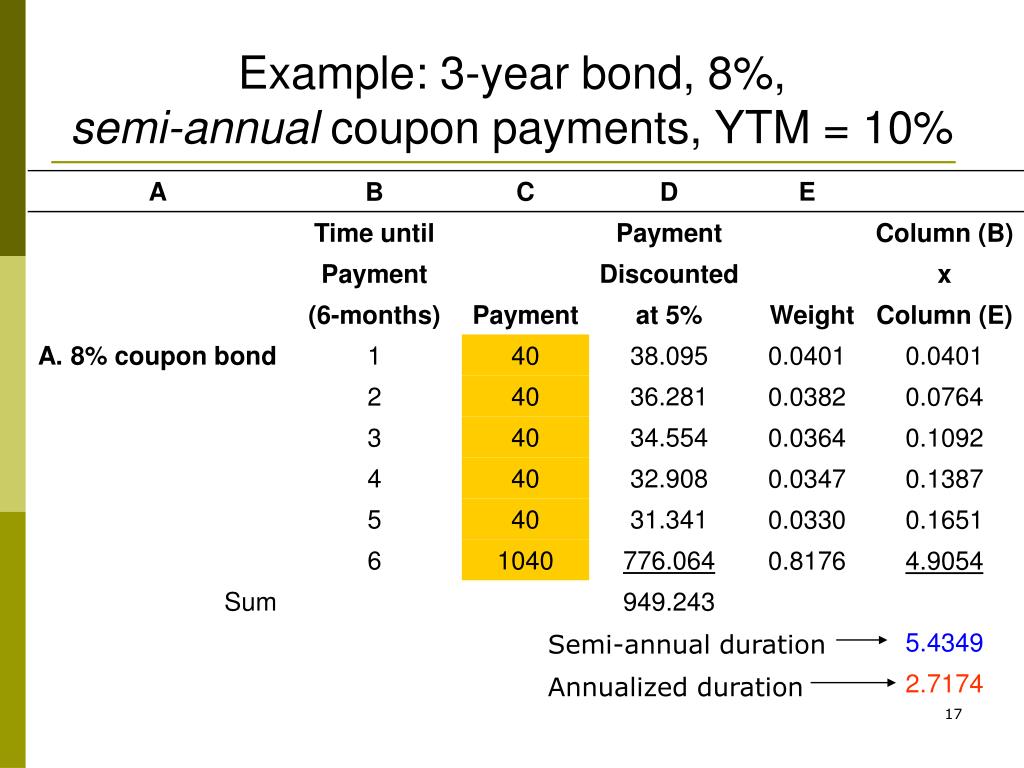

Coupon rate semi annual. Bond Prices: Annual Vs. Semiannual Payments | Pocketsense The more frequent a bond pays its coupon payments, the higher the effective yield of the bond under the same annual coupon rate. If a bond pays coupon interest semiannually instead of annually, it will compound interest twice rather than once, increasing total bond returns at the end of a year. Solved Suppose a 10-year, $1,000 bond with an 8.1% coupon ... Suppose a 10-year, $1,000 bond with an 8.1% coupon rate and semi-annual coupons is trading for a price of $1.034.94. a. What is the bond's yield to maturity (expressed as an APR with semi-annual compounding)? b. If the bond's yield to maturity changes to 9.1% APR, what will the bond's price be? . a. Exercises Yield Duration Convexity.xlsx - Par Price N 1000 ... Coupon rate Par Coupon Mod Duration 6% 1000 60 10 a) YTM' P' varP 9% 720-80 Semi-annual Coupon rate Par Coupon 0.5 6% 1000 30 b) YTM' Predicted cotribution to the % chan 9.50% 1.35% Coupon rate Par Coupon 8% 1000 80 c) Mod Duration 8.1818182 Coupon Bond Formula | How to Calculate the Price of Coupon ... Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

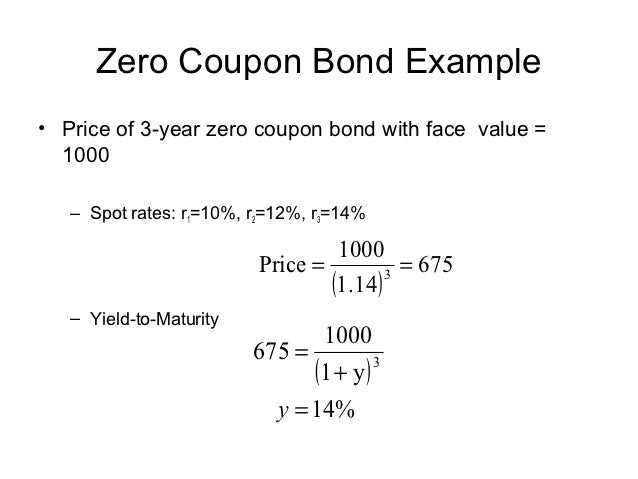

Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Coupon Rate - Meaning, Calculation and Importance The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Certified Semi-annual Shareholder Report for Management ... 11.03.2022 · Certified Semi-annual Shareholder Report for Management Investment Companies (n-csrs) March 11 2022 - 08:25AM Edgar (US Regulatory) UNITED ... Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Suppose you have a bond and its face value is $1000 with the present price of $900, and the coupon rate is 2%. Its maturity period is also five years. So, when we calculate the semi-annual bond payment, first of all, we have to get 2% of the face value of $1,000, which is $20, and after that, we have to divide it by two.

Bond Yield Definition 01.01.2022 · In this example, the BEY of a bond that pays semi-annual coupon payments of $50 would be 11.958% (5.979% X 2 = 11.958%). The BEY does not account for the time value of money for the adjustment ... How to Calculate the Price of a Bond With ... - The Nest Therefore, you would use 5 percent as your required rate of return. Converting Payment Periods Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent per semiannual period. Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... TIPS: TIPS pay a regular semi-annual coupons while the principal can be redeemed at the greater of the original principal amount or their inflation-adjusted equivalents. FRN: Floating rate notes pay quarterly interest based on discount rates for 13-week treasury bills, with the principal paid at maturity.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Yield to Maturity (YTM): Formula and Excel Calculator Given those inputs, the next step is to calculate the semi-annual coupon rate, which we can calculate by dividing the annual coupon rate by two. Semi-Annual Coupon Rate (%) = 6.0% ÷ 2 = 3.0% Then, we must calculate the number of compounding periods by multiplying the number of years to maturity by the number of payments made per year.

Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

How to convert the effective semi-annual rate to APR - Quora Answer (1 of 4): To convert a semi-annually compounded rate to an annually compounded rate you do these steps: Calculate How much the value will increase in one semi annual period (1+rate/2) Multiply that by itself, because you want to know how much you will have at the end of one year, and sub...

Semi-annual rate - ACT Wiki The semi-annual rate is the simple annual interest quotation for compounding twice a year. Coupon rates on bonds paying interest twice per year are generally expressed as semi-annual rates. This makes rates broadly comparable, while also enabling the amounts of fixed interest coupons to be determined easily. Example: Semi-annual rate calculation

Bond Price Calculator - Brandon Renfro, Ph.D. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon payments. The calculator will make the necessary adjustments to your annual coupon if you select this option.

Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually.

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2 Coupon Payment = $6,000 / 2 = $3,000 Bond Coupon Rate Calculation Steps

Post a Comment for "44 coupon rate semi annual"